There is a problem with renewables. They are meant to be cheaper than fossil fuels, but as we add more of them our electricity prices have been rising. This has led to some of our politicians claiming the price rises are due to renewables themselves, which seems to make some sense. Doubling up our electricity production so we have renewables for when it's sunny and/or windy and gas/nuclear for when it's not seems like it could be a more expensive option. So let's not worry about climate change and don't bother building any more renewables. Right?

Except that's not what's happening. With our current level of renewables, we are never turning off some of our gas powered stations. And electricity in the UK is priced at the level of the most expensive producer, so it is always tied to the price of gas. And the price of gas shot up after Russia's invasion of Ukraine and is still higher than it was previously.

But, perhaps reasonably, some people will be sceptical of this explanation until they see their electricity bills falling. So I thought I'd try to figure out when we should see gas falling out of our generation mix. I downloaded the historic data from NESO and did some simple analysis of it

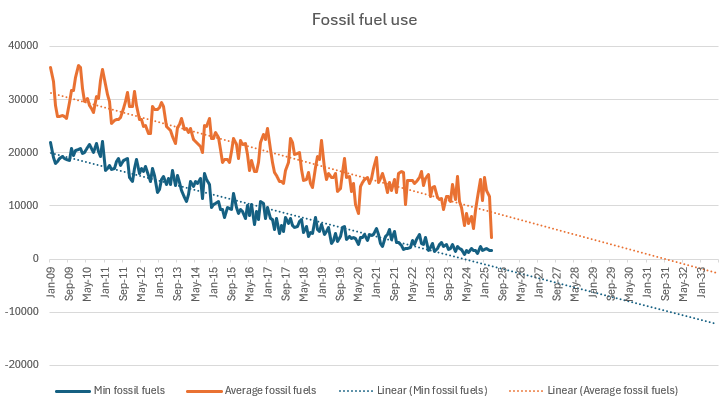

For every month, this shows the minimum and average usage of fossil fuels over a half hour period, both with a linear trendline, which mostly fits the data sets.

The first milestone we should hit is a period of 30 minutes where we don't use any fossil fuels. The linear trendline suggests we should have already hit that milestone, but the drop seems to have stalled over the last couple of years. Maybe someone with a better understanding of the National Grid can explain why that has happened, but it seems like something we'd want to happen as quickly as possible from the consumers' point of view. I think that possibly from the government's point of view it may not be something they'd like to happen too soon. From my understanding, renewables get a fixed price for their electricity, if the wholesale price goes below that price, the government pays the difference.

The next milestone will be when the average fossil fuel usage gets to zero. That trendline is looking linear at the moment but I'd expect that to flatten as it approaches zero. In long periods of low wind and sun, storage is not going to be able to meet demand. So maybe it's better to look at renewable electricity production.

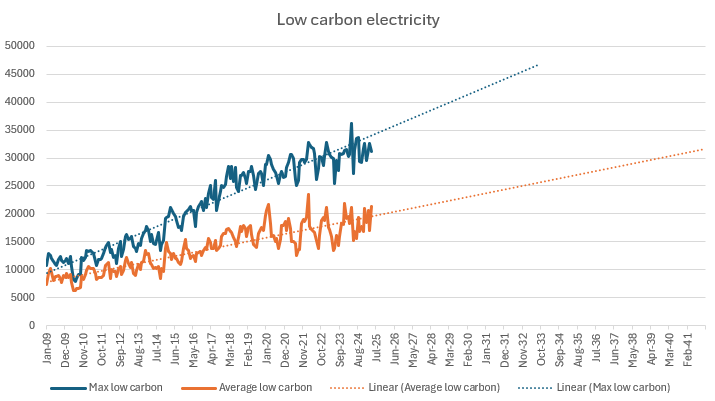

The NESO low carbon figures include nuclear, wind, solar, hydropower and biomass (eugh) and the maximum and average are displayed above. The UK typically requires about 30GW of electricity and the trendline suggests we'll reach that average level in about 2039. Then we'll be producing enough electricity by renewables to meet our needs but some of that will be getting exported when we are producing too much so we will probably still be using gas for some periods. My understanding is that is the definition the government is using for a green National Grid which they hope to reach by 2030, so our renewables output is really going to need to step up a few gears in the next few years to reach that goal.

Supported by National Energy SO Open Data